Social Security Withholding Income Limit 2025 - Social Security Tax Limit 2025 Withholding Chart Andra Blanche, Five things to know about social security and taxes; 2025 Max Social Security Tax By Year Chart Conny Diannne, The 2025 limit is $168,600, up from $160,200 in 2023.

Social Security Tax Limit 2025 Withholding Chart Andra Blanche, Five things to know about social security and taxes;

Social Security Limit 2025 Withholding Bel Rosemary, In 2025, the earnings limits for retirees receiving social security benefits will change.

Maximum Social Security Tax 2025 Withholding Gretel Phaidra, After an employee earns above the annual wage base, do not withhold.

Social Security Tax Limit 2025 Withholding Tax Sonya Elianore, If you are reaching full retirement age in 2025, you can earn up to $59,520 in.

(for 2023, the tax limit was $160,200. We raise this amount yearly to keep pace with increases in average wages.

Social Security Withholding Limit 2025 Vyky Amaleta, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.

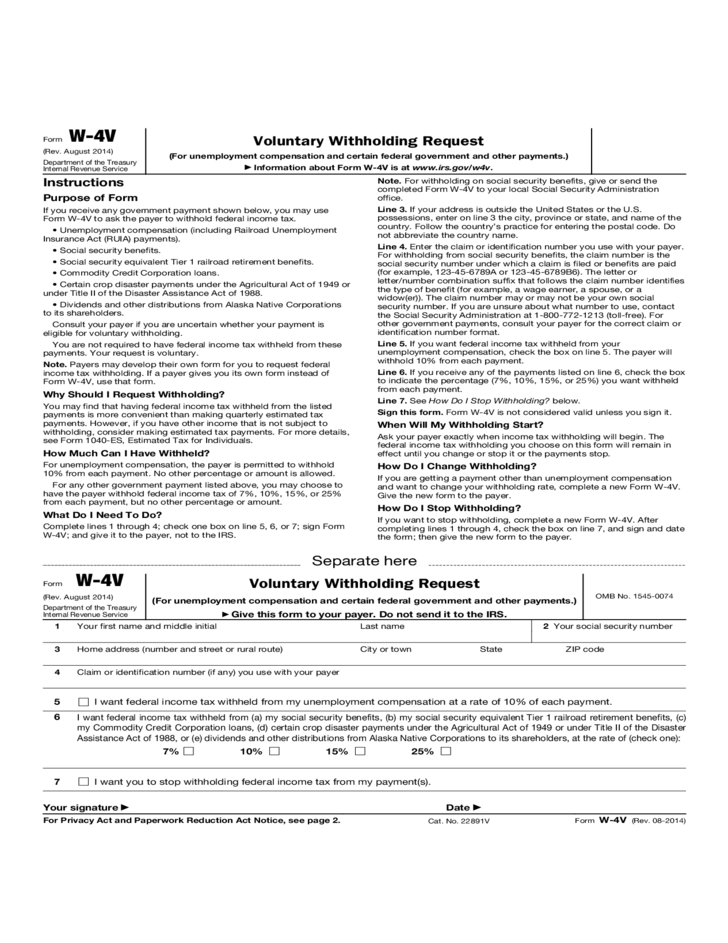

Social Security Withholding Income Limit 2025. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Workers earning less than this limit pay a 6.2% tax on their earnings.

Social Security Tax Limit 2025 Withholding Form Dory Helaine, Workers earning less than this limit pay a 6.2% tax on their earnings.

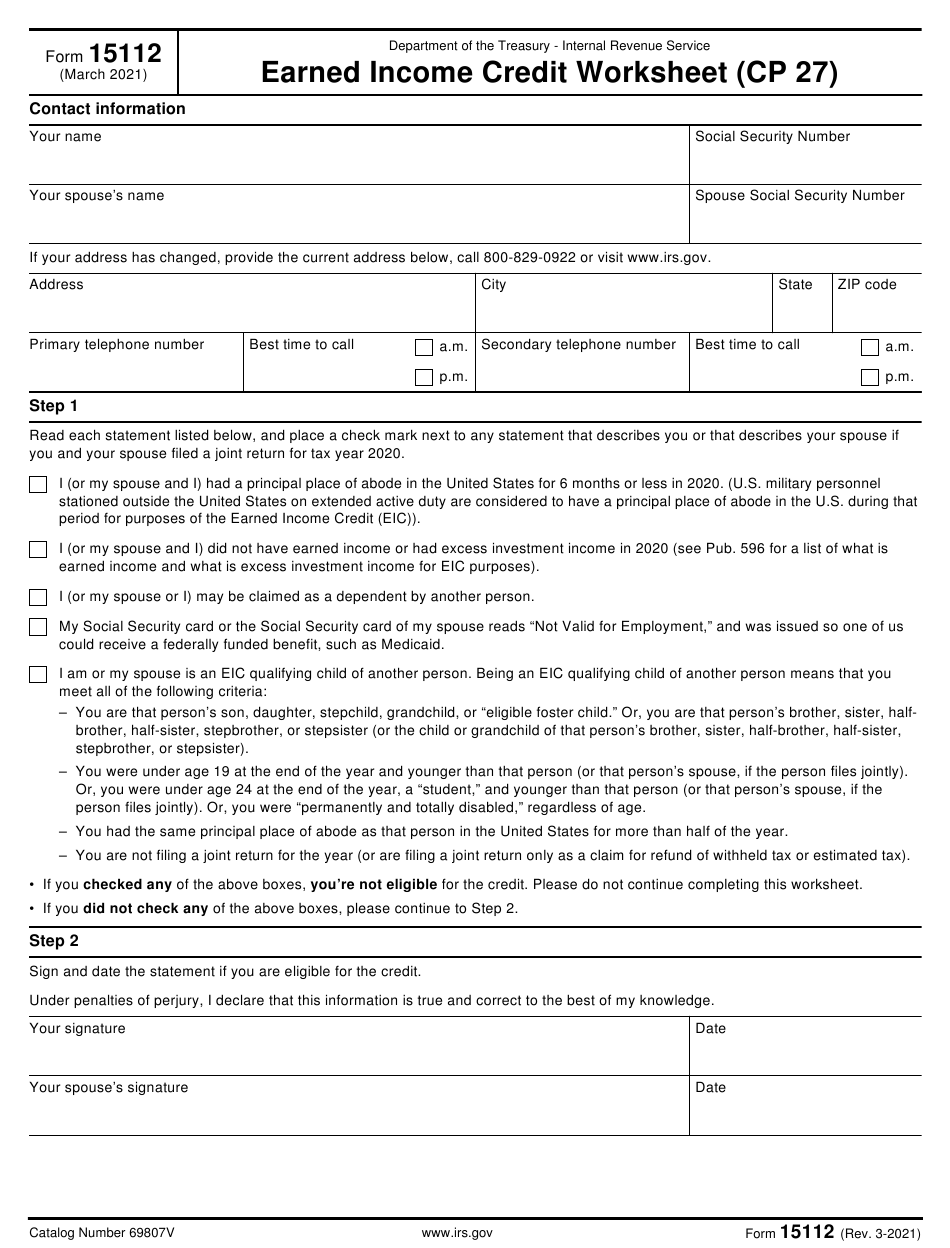

Social Security Limit 2025 Withholding Bel Rosemary, Single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their social security benefits.

Social Security Tax Limit 2025 Withholding Form Ashlan Kathrine, The wage base or earnings limit for the 6.2% social security tax rises every year.